WA 84 0001a 2013 free printable template

Show details

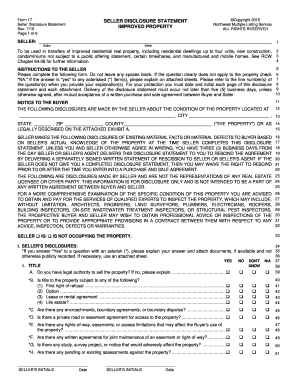

REAL ESTATE EXCISE TAX AFFIDAVIT PLEASE TYPE OR PRINT CHAPTER 82.45 RCW CHAPTER 458-61A WAC when stamped by cashier. THIS AFFIDAVIT WILL NOT BE ACCEPTED UNLESS ALL AREAS ON ALL PAGES ARE FULLY COMPLETED

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WA 84 0001a

Edit your WA 84 0001a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WA 84 0001a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WA 84 0001a online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit WA 84 0001a. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA 84 0001a Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WA 84 0001a

How to fill out WA 84 0001a

01

Obtain the WA 84 0001a form from the relevant authority or website.

02

Read the instructions carefully to understand the required information.

03

Fill out your personal information in the designated fields, including your name, address, and contact details.

04

Provide any necessary identification numbers or references as prompted on the form.

05

Complete any sections that pertain to your specific situation, ensuring all required fields are filled.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form as per the given instructions, either in person or via mailing it to the specified address.

Who needs WA 84 0001a?

01

Individuals applying for a particular government service or benefit that requires the WA 84 0001a form.

02

Residents of the state or region who need to provide specific information for verification.

03

Organizations or entities that need to maintain compliance with local regulations requiring the use of this form.

Fill

form

: Try Risk Free

People Also Ask about

What is Washington state transfer tax?

How much are transfer taxes in Washington? The REET in Washington State is: 1.1% on homes less than $500,000. 1.28% on homes between $500,000 and $1,500,000. 2.75% on homes between $1,500,000 and $3,000,000.

What is Form 84 0001A Washington?

This form must be used for reporting transfers of controlling interest and for buyer disclosure to the Department of Revenue. (Use Form No. 84-0001A for reporting transfers by deed or real estate contract to the county treasurer/recorder of the county in which the real property is located.)

Who pays the transfer tax in Washington state?

The seller of the property typically pays the real estate excise tax, although the buyer is liable for the tax if it is not paid. Unpaid tax can become a lien on the transferred property. REET also applies to transfers of controlling interest (50% or more) in entities that own real property in the state.

What taxes do I pay when I sell my house in Washington state?

What is Washington's real estate excise tax? For the portion of the selling price that is:Real Estate Excise Tax RateLess than or equal to $525,0001.1%Greater than $525,000 and less than or equal to $1,525,0001.28%Greater than $1,525,000 and less than or equal to $3,025,0002.75%Greater than $3,025,0003.0% Feb 17, 2023

What is the new excise tax in Washington state?

Background. Passed by the 2021 Washington State Legislature, ESSB 5096 (RCW 82.87) created a 7% tax on any gain in excess of $250,000 in a calendar year from the sale or exchange of certain long-term capital assets such as stocks, bonds, business interests, or other investments and tangible assets.

Who pays state and local transfer taxes?

Who Pays Transfer Taxes: Buyer or Seller? Depending on the location of the property, the transfer tax can be paid either by the buyer or seller. The two parties must determine which side will cover the cost of the transfer tax as part of the negotiation around the sale.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send WA 84 0001a to be eSigned by others?

When you're ready to share your WA 84 0001a, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit WA 84 0001a in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your WA 84 0001a, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my WA 84 0001a in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your WA 84 0001a and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is WA 84 0001a?

WA 84 0001a is a form used for reporting specific information required by the Washington state authorities, typically related to taxation or compliance requirements.

Who is required to file WA 84 0001a?

Individuals or entities that meet certain criteria set forth by Washington state regulations, such as businesses operating in the state or those who have taxable transactions.

How to fill out WA 84 0001a?

To fill out WA 84 0001a, provide the required information as prompted on the form, including identification details, relevant transaction data, and any additional information specified by the instructions.

What is the purpose of WA 84 0001a?

The purpose of WA 84 0001a is to collect necessary information for compliance, auditing, or tax assessment purposes to ensure adherence to state regulations.

What information must be reported on WA 84 0001a?

The form typically requires information such as the filer’s identification, transaction details, applicable tax information, and any other data required for compliance with Washington state laws.

Fill out your WA 84 0001a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WA 84 0001a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.